For years, my budget consisted of an Excel spreadsheet that documented every purchase I made every single day of the year. As a numbers gal, this wealth of data was amazing and helped me tweak my spending, find my financial leaks, and reach financial goals much sooner than I would have without budgeting. Since then, I’ve been tentatively using online personal finance tools because of the security issue and instead I rely on Quicken’s app, which is one of the most comprehensive tools available.

What if you just want to maintain a budget? Enter You Need A Budget. You Need A Budget, often called YNAB, is a budgeting software that will help you set, maintain, and stick to a budget. It’s a much better version of what I used to hack together in an Excel spreadsheet.

YNAB Methodology: Four Rules

Before we get into the review of You Need a Budget software itself, I wanted to write about the basic premise of the whole system. Budgeting is almost never about the tools but how the tools establish a framework for which to think about your budget. For example, with my Excel spreadsheet, I molded it to match my own budgeting mentality. If you very good with budgeting and love hacking around with Excel, then Excel is probably right for you.

If your approach to budgeting is similar to YNAB’s methodology or if you have no approach, then you would do well to adopt the YNAB framework, with or without their software. You can budget with a pen and piece of paper, it’s just easier when you have a powerful application guiding you.

The YNAB Methodology is YNAB’s approach to budgeting and establishes a good framework. The steps are:

- Rule One: Stop Living Paycheck to Paycheck – A notebook won’t help you stop yourself from living paycheck to paycheck, but YNAB will. You will have two types of income, primary and supplemental. When you start the system, you’ll record all your income, even if it’s from your primary job, as “supplemental.” Supplemental means that you will be spending the income in the current month. You are, in a sense, living paycheck to paycheck because you spend the money in the month you earn it. As you work through the system, eventually you’ll reach a point where your job income will be listed as primary income, to be budgeted for use in the next month. This is important because when you go to the budget section, the income will appear in the next month. The tool has, in effect, taken you off living paycheck to paycheck.

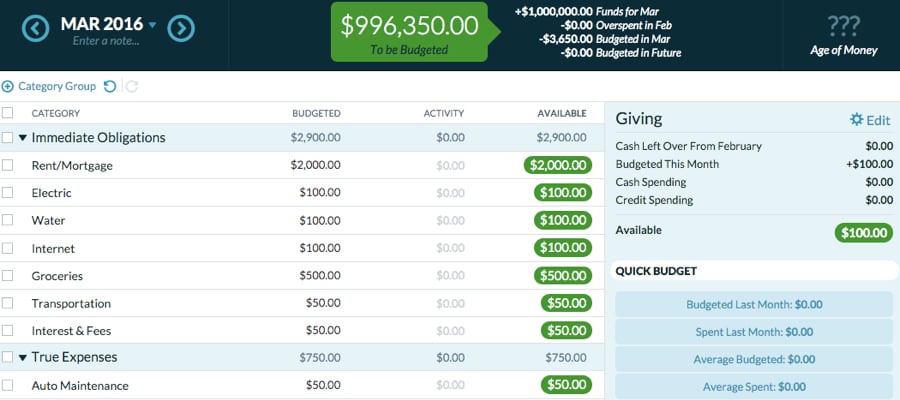

- Rule Two: Give Every Dollar a Job – This rule enforces zero-based budgeting, where every single dollar is assigned to a category. The value in budgeting like this is that you have accounted for every penny you have in your budget. So many times we just budget for the big things – food, rent, etc. The act of sitting down and setting these numbers is tremendously valuable because you’re actively making decisions, rather than letting things happen.

- Rule Three: Save for a Rainy Day – This rule is less about the tool and more about the idea of creating various savings funds whether they’re for emergencies, annual taxes, holiday spending, etc. This fits in line with the zero-based budgeting because these are entries in your budget.

- Rule Four: Roll with the Punches – This is a great feature of YNAB that a lot of other packages don’t have. What happens when you go over your budget? Most other packages warn you, tell you not to do it next time, and probably do nothing about it. YNAB will deduct it from next month’s available funds. This is good.

I especially love Rule Two, Give Every Dollar a Job, because it is the cornerstone of budgeting and, subsequently, the YNAB approach. They work off the zero-based budgeting system where every single dollar you bring in is accounted for. If you earn $1,000 a month, every single dollar is earmarked for something before the month begins. If you are over or under, you adjust your budget accordingly the following month.

On the tutorials page, there are short videos explaining how YNAB is used to support those four rules. I recommend watching them even if you have no intention of using YNAB because they easily explain some good budgeting principles. I found value in the rules themselves but having a video translate it into how it’s applied in YNAB was great.

You Need A Budget & YNAB Pro

You Need a Budget comes in two flavors, the basic edition, and a Pro version. The basic version is going to be phased out soon so I didn’t want to spend too much time reviewing it. It’s a hardcore Excel spreadsheet, costs the same as the Pro version, and doesn’t contain as many features. They both work off the same YNAB Methodology, except with the Pro version you don’t need MS Excel because it is itself an app.

If you had a chance to see the videos, then you have a general review of the features of the Pro version. The Pro version is a full desktop application and the free 37-day trial gives you access to every feature in the application. This isn’t a watered down trial, it’s the real deal. The trial is for thirty seven days, instant digital download, and the full version is regularly $49.95. All that, full support, and it comes with a 30-day money-back guarantee.

Importing Data

Not every piece of data has to be manually entered into the register, YNAB is able to important OFX, QFX, QIF, and CSV files from major financial institutions. It’s the same files used by Quicken and MS Money and YNAB will never ask you for sensitive information. You visit the bank, you enter your credentials, and you download the files yourself. It’s an extra step but it’s secure because you aren’t giving a third party any sensitive information.

Reporting

YNAB has some pretty looking reporting features that include pie charts and bar graphs. Visualizing your budget is difficult when you’re just looking at a list of numbers and YNAB does a fine job display your spending in three easy to view charts. There is a pie chart that illustrates Spending by category, a bar graph that shows total spending across several months, and then a final one showing current balances of various categories.

Five Bonus Spreadsheets (with Pro)

Five bonus spreadsheets come with the YNAB Pro package:

- YNAB Debt Snowball – Based on Dave Ramsey’s debt snowball strategy

- Income Tax Planner – This can help you plan for your tax return.

- YNAB Retirement Planner – You can use this spreadsheet to help plan your retirement, including contingency plans.

- YNAB Mortgage Analyzer – If you have a mortgage, you can use this spreadsheet to help figure out how to pay it down faster, whether a refinance makes sense, etc.

- YNAB Car Maintenance Schedule – Need a little help figuring out when you should be bringing the clunker in for maintenance? This spreadsheet can help you out on that.

I have not seen these spreadsheets first hand so I can’t make a determination of how good they are.

Live Online Budgeting Classes

Another nice feature I am 100% certain other budgeting packages don’t offer are free classes. If you are not good at budgeting or would like to take advantage of live classes that introduce you to the YNAB system and how to manage your finances, YNAB offers absolutely free classes several times a month. You can review the schedule to see what’s available. Classes are free, are limited to forty attendees, and include a live Q&A at the end of the session.

Conclusion

Whew! That pretty much covers the YNAB system. When I first started this, I had no idea what I was getting myself into. This is quite possibly one of the longest reviews I’ve written in part because the product has so many features, is built on a sound financial foundation, and is about to release a brand new, soup to nuts, version.

If you’ve been searching around for budgeting software, I recommend giving YNAB a look because with their 37-day trial, you can get a good sense of whether it’s right for you.